If Africa’s smallholder farmers remain locked out of finance, how can we expect to build a sustainable global food system?

Unfortunately, this is the case for smallholder farmers who rise before dawn to cultivate the crops that feed 80% of Africa’s population, yet most earn less than USD 500 annually. Despite agriculture contributing 20–40% of GDP in many African countries, commercial banks still allocate less than 6% of their lending portfolios to agriculture, leaving a USD 75–170 billion financing gaps (AfDB, World Bank).

Traditional banking systems see farmers as high-risk borrowers. Their incomes are small and seasonal, rural populations are sparse, and low financial literacy limits formal participation. As a result, opportunities for higher yields, profitability, and innovation remain untapped.

Mercy Corps AgriFin and UNCDF: Catalyzing the Conversation

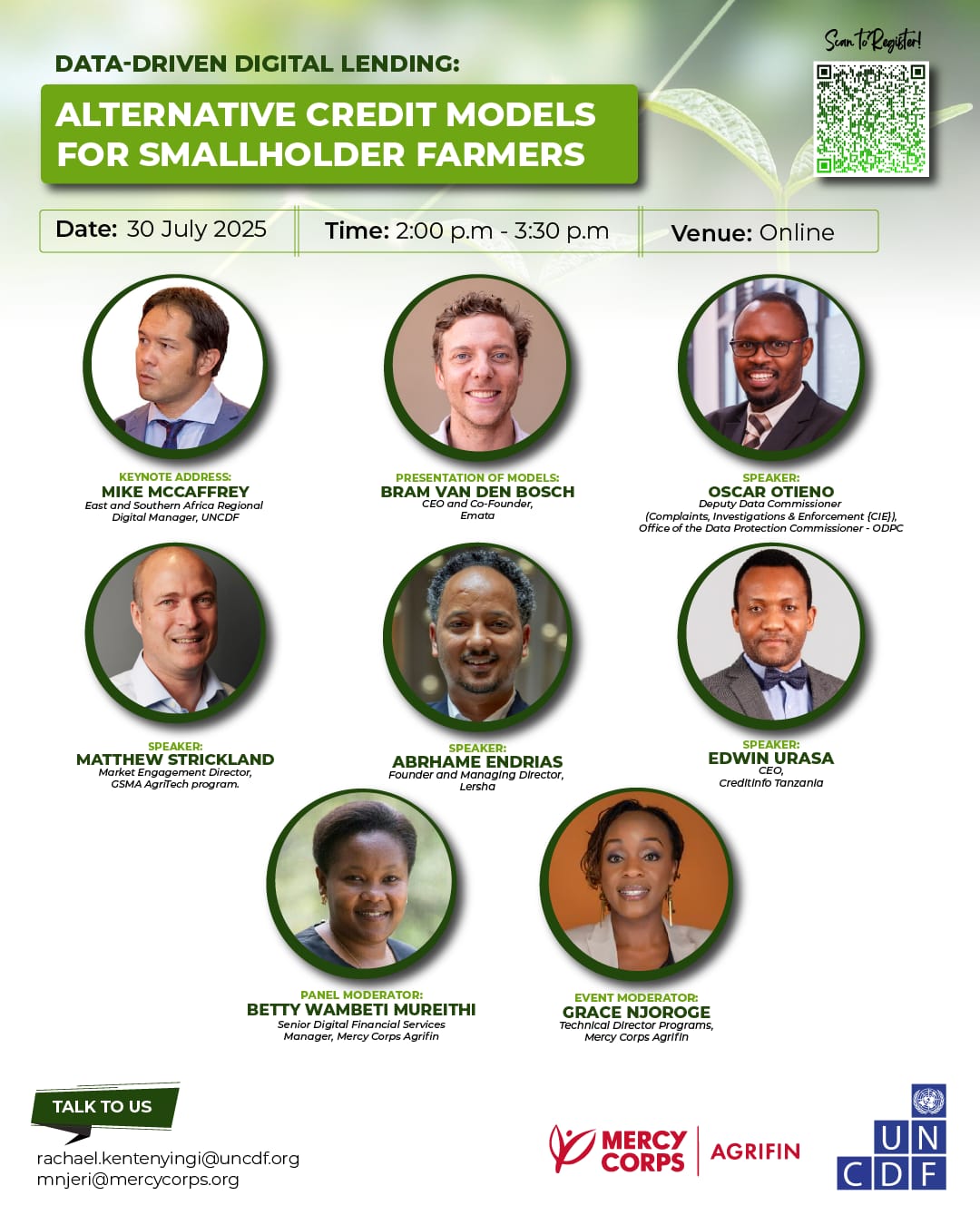

Against this backdrop, Mercy Corps AgriFin, in partnership with UNCDF, convened the webinar “Alternative Credit Models for Smallholder Farmers” on July 30th, 2025, bringing together financial institutions, policymakers, AgriTech innovators, and global experts to explore how data, technology, and partnerships can transform rural lending. This webinar was the first of a three-part series that we will be hosting in partnership with UNCDF over the next two months.

Opening the conversation, Grace Njoroge, our Technical Director Programs at Mercy Corps AgriFin, set the tone: “This is not just about giving farmers loans. It is about reimagining them as bankable entrepreneurs and creating pathways for them to thrive.”

From there, the dialogue unfolded into a rich exploration of the barriers, innovations, and emerging solutions redefining how the world sees Africa’s farmers from “risky” to truly “bankable.”

Mike McCaffrey, East and Southern Africa Regional Digital Manager, UNCDF began by painting a clear picture of the challenge: despite years of fintech innovation, smallholder farmers remain largely invisible to formal finance.

He broke the barriers down into three familiar yet persistent realities:

- Low and seasonal incomes make farmers appear too risky for banks.

- Sparse rural populations and weak infrastructure make lending costly.

- Low digital and financial literacy means even available services are often underused.

Even in Kenya, one of the pioneers of mobile financial inclusion, most farmers still lack access to productive credit. “Sending money is easy,” Mike observed, “but lending is a different story. Farmers need credit that matches their harvest cycles, input needs, and risk profiles.”

Mike argued that data-driven, algorithmic lending is the way forward. By leveraging alternative data such as farmer behavioral and productivity data instead of collateral, institutions can finally reach this “invisible market.” He cited global and regional precedents:

- PayPal’s USD 3 billion small business lending powered entirely by transaction data

- Pezesha which uses ecosystem data to unlock working capital for micro-entrepreneurs

“If we can turn farmers’ daily transactions into trusted data,” he concluded, “we can shift them from invisible to investable.”

Innovation in Action: Lersha and EMATA

The webinar highlighted two AgriTech pioneers, Lersha in Ethiopia and EMATA in Uganda, whose models demonstrate how data can unlock bankability for rural farmers.

- Lersha: Data-Driven Lending in Ethiopia

Abrhame Endrias, CEO of Lersha, shared Ethiopia’s paradox: The National Bank requires lenders to allocate 5% of their portfolios to agriculture, yet farmers access only 2%, primarily because banks lack the data to assess risk.

Lersha’s solution bridges this gap by:

- Deploying community extension agents with an offline-ready, multilingual mobile app

- Collecting 137+ data points per farmer covering agronomy, psychometrics, gender, and climate indicators

- Creating tailored credit scores that enable USD 250–450 loans, often disbursed as farm inputs instead of cash, which has led to near 100% repayment in some value chains

“We built this model not just to reduce defaults,” Abrhame explained.

“It helps banks see farmers as long-term, viable customers.”

Lersha now partners with six commercial banks and two mobile operators, integrating farmer data directly into loan management systems via APIs, and customizes models by value chain which can range from cereals and coffee to livestock.

- Bram van den Bosch, CEO of EMATA, shared a complementary story: digitizing value chains to unlock seasonal lending.

EMATA’s four-step model is simple yet transformative:

- Digitize farmer and cooperative transactions

- Credit score based on historical deliveries and behavior

- Lend and insure with seasonal, value-chain-aligned loans (~USD 350)

- Repay via produce deliveries, reducing cash risks and defaults

The results speak volumes:

- 95%+ repayment rates

- 30% income growth for farmers

- 80% increase in cooperative deliveries, curbing side-selling

In 2024, EMATA disbursed USD 1.5 million in loans and plans to triple this in 2025, with a USD 100 million five-year goal as they expand into Tanzania and Ethiopia.

Together, Lersha and EMATA illustrate a critical truth: when finance follows data, rural farming becomes bankable, scalable, and investable.

Panel Insights: Building a Data-Driven Lending Ecosystem

The webinar culminated in a dynamic panel discussion, moderated by Grace Njoroge, featuring:

- Oscar Otieno –Deputy Data Commissioner (Complaints, Investigations & Enforcement {CIE}Office of the Data Protection Commissioner – ODPC

- Matthew Strickland – Market Engagement Director, GSMA AgriTech Programme

- Edwin Urasa – CEO, Creditinfo Tanzania

- Betty Mureithi –Senior Digital Financial Services Manager Mercy Corps Agrifin

The conversation revealed the following critical enablers for scaling rural credit:

1. Trust Is the Currency of Digital Finance

Oscar Otieno emphasized that responsible data use and farmer trust are non-negotiable. Farmers must know and consent to how their data is collected and used, while lenders must comply with the different countries’ Data Protection Acts.

“Without trust and transparency,” he cautioned, “Even the most innovative models will fail.”

2. Multi-Source Data Unlocks Lending

Edwin Urasa illustrated how ecosystem-level data helped CreditInfo Tanzania transform inclusion in Tanzania. Here are some of the key takeaways:

- Their partnerships with Vodacom and DTB Bank created the first mobile credit scorecard, now reaching 500,000+ users

- Their focus on the Sugarcane value chain in Kilombero Valley reached 10,000+ farmers, using verified data from off-takers, cooperatives, and the Tanzania Sugar Board

- Working with the Kilombero sugar factory, really assisted them as it acted as the data hub tracking harvests, payments, and linking banks to farmers via AMCOs.”

- They are planning to integrate tax and government records to further de-risk agricultural loans

He also flagged a critical challenge:

“Gender disparities persist—many women lack IDs and rely on their husband’s phones, complicating KYC. And rural realities often don’t match central bank data requirements, limiting CRB reporting.”

3. Global Lessons for Local Impact

Matthew Strickland drew parallels from Papua New Guinea’s vanilla farmers, where tripartite partnerships between AgriTechs, banks, and farmers thrive in low-infrastructure environments.

GSMA’s model:

- Digitize supply chains to generate trusted transaction data

- Offer small loans ($80–$300) with risk-sharing guarantees

- Build credit histories through repeat behavior

4. Bundled, Farmer-First Solutions

Closing the panel, Betty Mureithi of Mercy Corps AgriFin emphasized the power of bundled solutions and ecosystem design:

- Bundled, farmer-first solutions: Combine credit, insurance, and market access with insights gathered from years of sector experience to create customized financial products for smallholder farmers.

- Graduated loan models: Start farmers with small, low-risk loans, increasing amounts as their behavior and repayment capacity become clearer.

- 360° farmer view: Build comprehensive profiles by tracking digital footprints, transaction histories, input purchases, and seasonal farming activities.

- Peer and group lending: Farmer groups and savings groups—especially for women—offer peer monitoring and faster access to loans.

- Value chain and cooperative leverage: Understanding seasonal yields, structured value chains, and aggregator roles helps reduce risk and expand access to finance.

Her message was clear: credit alone is not enough. Farmers succeed when finance, knowledge, and markets converge.

The Road Ahead: A Farmer-First Future

The Mercy Corps AgriFin x UNCDF webinar ended with a shared conviction:

Africa’s smallholder farmers are not unbankable, they are under‑served.

By embracing Alternative credit models, Data‑rich lending ecosystems and Multi‑stakeholder collaboration Africa can:

- Boost farmer productivity and incomes

- Strengthen agricultural value chains

- Unlock billions in commercial rural finance

As one panelist concluded:

“When you unlock finance for farmers, you don’t just grow crops—you grow economies.”