[et_pb_section fb_built=”1″ _builder_version=”4.17.0″ _module_preset=”default” global_colors_info=”{}” theme_builder_area=”post_content”][et_pb_row _builder_version=”4.17.0″ _module_preset=”default” min_height=”3876.5px” global_colors_info=”{}” theme_builder_area=”post_content”][et_pb_column type=”4_4″ _builder_version=”4.17.0″ _module_preset=”default” global_colors_info=”{}” theme_builder_area=”post_content”][et_pb_text _builder_version=”4.20.4″ _module_preset=”default” hover_enabled=”0″ global_colors_info=”{}” theme_builder_area=”post_content” sticky_enabled=”0″]

Alternative credit scoring methods are gaining traction as a means of reducing barriers to financial inclusion. Social Lender in Nigeria offers digital financial services based on social reputation. We reviewed the effectiveness in predicting borrowers’ ability and willingness to repay loans.

>Download the PDF version of this blog post.

Context

Smallholder farmers face challenges accessing credit from formal financial services which hinder their ability to increase their access to resources, markets and ability to build resilience. Formal financial institutions require traditional forms of collateral that they may not have access to. Alternative credit scoring (ACS) mechanisms have emerged as a response to improving financial inclusion by providing alternative means by which consumers can access credit without traditional collateral. ACS uses artificial intelligence , social media and other innovative approaches as opposed to paper-based scoring methods that require one to have a bank account (World Economic Forum, 2021)

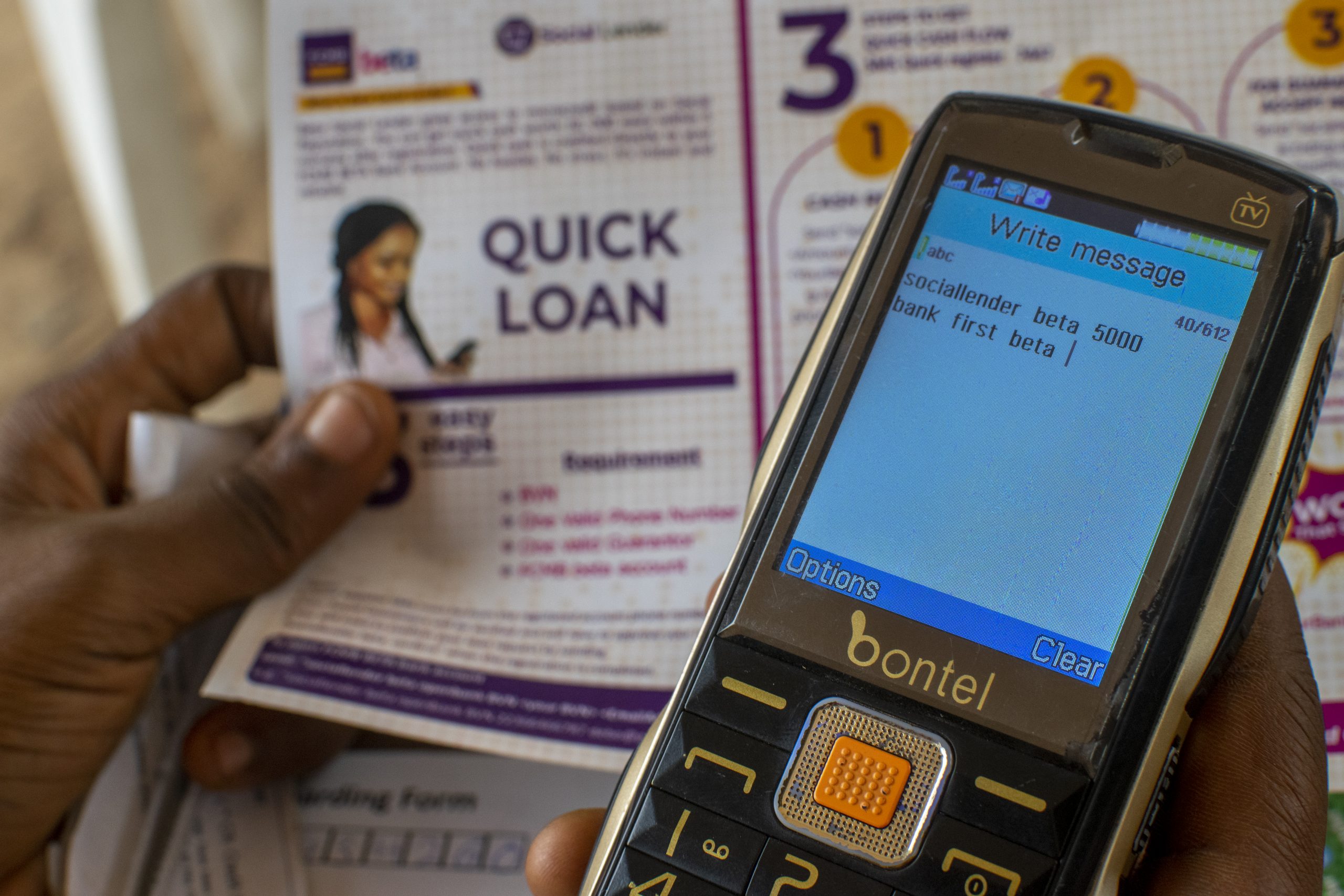

Social Lender is a Nigerian based financial services solution designed to bridge this gap of immediate access for people with limited access to formal financial services. It is based on social reputation on mobile, online, offline and social community platforms. Social Lender uses its own proprietary algorithm to perform a social audit of the user on mobile, social media, online and other related platforms and gives a Social Reputation Score to each user. Access to Financial Services is guaranteed by the user’s social connection, profile and network. Users can then access services from banks and other partner institutions based on their social reputation. Instead of providing traditional forms of collateral (the norm for this segment in Nigeria), applicants provide access to various data points including sharing their contact information. These social contacts in turn validate the identity of their friend or family member on the platform and sometimes agree to guarantee a portion of the loan. (CGAP, 2019) Social Lender’s Social Reputation Score leverages online and offline connections between individuals to build creditworthiness and offer credit to low-income people to fill cash-flow gaps.

This use of community ties to build trust and increase repayment likelihood is consistent with the success found in solidarity groups commonly used in the ‘microfinance’ movement started in 1983 by Muhammad Yunus and Grameen Bank. Alternative Credit Data leverages unconventional data from consumers’ social circles with conventional data sources that would predict their creditworthiness.

The primary purpose of this engagement was to validate the Social Reputation Score’s effectiveness in predicting borrowers’ ability and willingness to repay loans. We reviewed Social Lender’s digital data streams and selected documentation describing how the Social Lender platforms and Social Reputation Score model works.

How it works

Currently, Social Lender’s Social Reputation Score prequalifies the smallholder farmers. They are trained on financial literacy and agricultural best practices and are subsequently given access to finance required to implement recommendations customized to each farmer. The result is increased yield and reduction of post-harvest losses. Furthermore, in partnership with microinsurance companies, Social Lender using the Social Reputation Score and leveraging on its Vast Ambassador network is providing access to Life and Non-Life covers to low-income earners, the unbanked and underbanked.

The solution has been specifically designed using an innovative risk management approach while also making the service affordable as well as readily available to the people at the bottom of the economic pyramid. Access to credit can be delivered on the platform with ease to users living below the poverty line and in rural areas.

Social Lender delivers credit approval, microinsurance and farm input guaranteed by Social Reputation in most cases within 10 minutes. In its road map, Social Lender seeks to be a platform that can be used in any use case where trust needs to be measured.

Evaluation of Social Lender Platform

Social Lender’s key innovation is its approach to collecting and evaluating data on a person’s social community reputation. Described as a “social audit of the users’ online, offline, mobile and other related platforms”, this “social audit” consists of requesting and obtaining concrete information and data from prospective borrowers, such as Personal Identity information; Banking Information, “Offline” Social Community, Friends, Followers and Connections; “Online” Social Community, Friends, Followers and Connections.

The Social Lender platform (see screenshot) also offers users the possibility to improve their Social Reputation Score by performing additional actions on the platform such as:

- Verify phone number

- Make transactions

- Obtain social guarantors

- Register friends as social referees

In order to reach and onboard potential borrowers in its target communities—settlements with low-income earners—Social Lender engages people in the roles of “Ambassadors” and “Local Guides”.

According to Social Lender, the data Ambassadors and Local Guides collect in the offline operation is the same data that would have been supplied directly should the user have been online. Yet, in this process of helping ‘offline’ communities digitize the target data set, Ambassadors and Guides educate end users and help them to avoid errors users might make without any human assistance. This process also generates additional data on the User.

Evaluation of the Social Reputation Score’s Predictive Power in Practice

Agrifin reviewed the effectiveness in predicting borrowers’ ability and willingness to repay loans. From the Social Reputation Score risk-ranking results, It is clear that overall the scores rank risk very well, with bad rates moving from a high of 62% for the worst 2% of scores to 1% for the best 3% of scores. Our analysis also shows that the current Social Reputation Score is relatively stable (and thus presumably algorithmically ‘fair’) across gender.

We observe a more than 40% point difference in delinquency rates for borrowers with a Social Reputation Score of 18 (54%) versus borrowers scoring over 40 points (7%).

The Social Reputation Score has ranked repayment risk well. Each subsequent implementation of the Social Reputation Score for lending that delivers similar results should further bolster potential partner’s confidence in the technology’s ability to access (onboard) and assess the risks of potential borrowers.

Statistical analysis of the data set shared by Social Lender indicates that statistical modelling techniques could further enhance the predictive power of the Social Reputation Score. In conversation with Social Lender, it is clear that it is committed to further building its data science capabilities.

The fact that the Social Reputation Score had similar and strong risk-ranking performance in two different implementations increases confidence in its “robustness” and stability across the target audience population (irrespective of specific loan products and financial institution credit processes and policies).

Social Lender currently calculates one proprietary Social Reputation Score for users —whether data was collected online or offline with the help of Ambassadors and Guides. There is no human intervention in the social reputation scoring process itself. However, a Social Credit Officer is sometimes used to either approve or disapprove any Cash Request which could not be automatically decisioned by the system.

The Social Reputation Score is based on an ‘expert’, rather than a statistically-derived model. The data types feeding into the score are dependent on how much data is available and the score is improved by Social Guarantors providing electronic personal guarantees on the personality of the borrower or the transaction. While the platform indicates that Guarantors are liable for loan repayment in case of default, it is difficult to enforce this.

Social Lender’s data set, not only the Social Reputation Score itself, are of potential value to financial institution partners. It bears emphasizing that financial institution counterparts working with Social Lender stand to benefit from the company’s technology platform and data collection mechanism which facilitate a range of financial activities including KYC verification, Obtaining the BVN needed to work with banks, Opening bank accounts and Basic financial literacy training of underserved communities.

Recommendations

Social lender has disclosed that its current data science operations are basic and primarily focused on monitoring the performance of the current Social Reputation Score, as well as to identify future data points that could potentially be used once it raises additional funding. The pragmatic next steps for Social Lender would be:

- Try building more machine learning models using its existing data sets. These need not be complex. Logistic regression models purposefully built to be transparent and exhibit intuitive relationships between borrower characteristics and behaviors and credit risk. Hybrid models can be tested alongside the existing Social Reputation Score and gradually phased into use if they will perform better than the existing score along for new cohorts of borrowers (in credit scoring literature this is called using a ‘champion/challenger’ strategy).

- Try building distinct scoring models for online and offline clients. In this same way, when data is adequate, it could be worthwhile to experiment with distinct models for clients with and without guarantors – in case the risk relationships for key parameters turn out to be different for borrowers in any of these groups.

- Introduce scorecard management reporting to track the stability of its Social Reputation score in current or future lending engagements. A suite of 3 standard reports such as Global Risk Ranking, Population Stability and Characteristic Analysis can be adapted to the current Social Reputation Score, given it was not statistically developed and its point scheme may differ from a ‘traditional’ point scheme. Social Lender may wish to separately analyze online and offline data sets in the future when building additional scoring models.

Financial institution counterparts working with Social Lender stand to benefit from the company’s technology platform and data collection mechanism in addition to the Social Reputation Score. Overall, Social Lender is expanding access to digital credits and other financial services for Nigeria’s smallholder farmers who are a largely underbanked.

>Download the PDF Version of this blog post

Related Articles

- For AgroMall, Extending Credit to Women Requires First Convincing Men

- DigiFarm Leveraging Credit Scoring to Serve Women Smallholder Farmers’ Financial Needs

- Impact of DigiFarm on Smallholder Farmers

- Optimizing Digital Data Sharing in Agriculture

- Social Networks and Agricultural Insurance- Learning from the Pula Referral System.

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]